Achmea

Implemented a new IFRS and Solvency II reporting chain including controls and dashboards.

Insurers need to disclose information regarding the balance sheet, income statement, changes in equity, cash flow statement and explanatory information. Below we focus on the balance sheet, income statement and changes in equity.

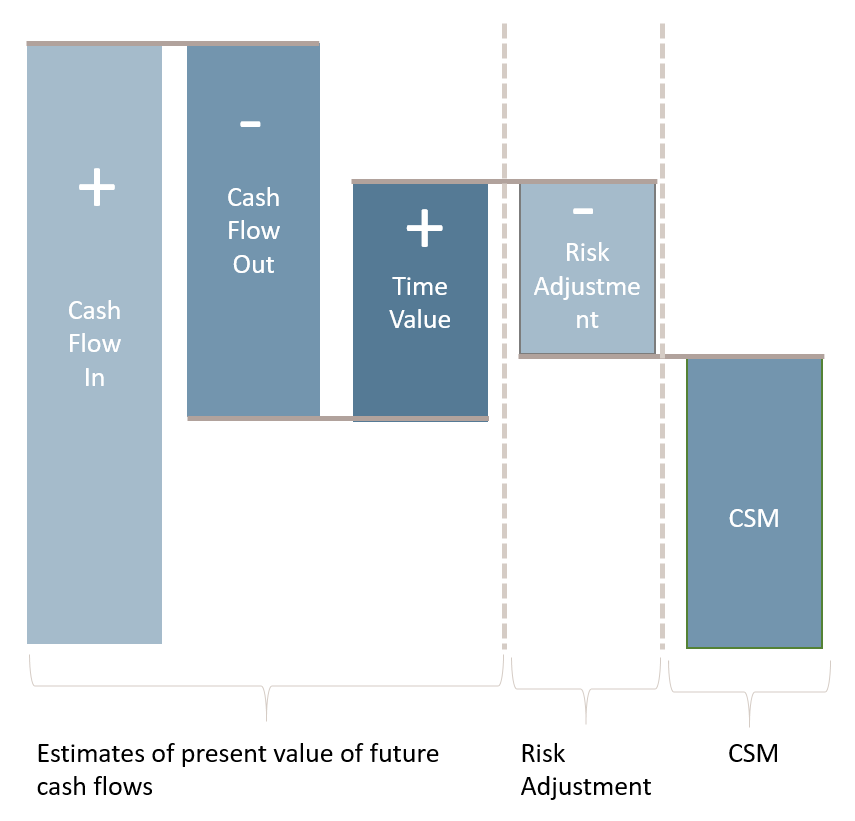

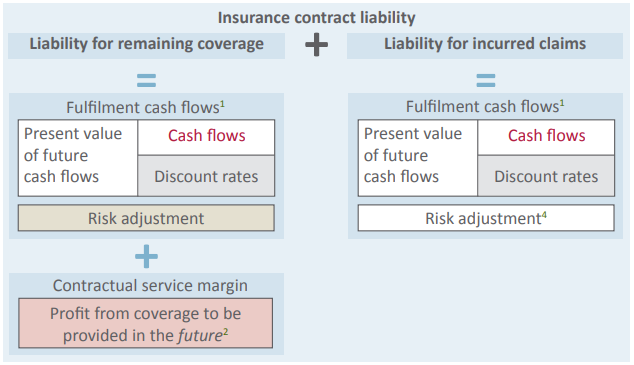

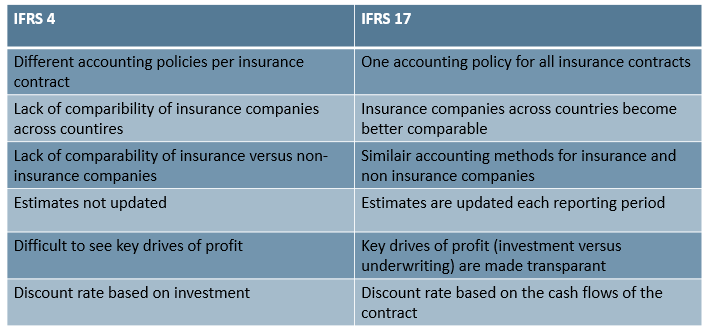

The insurance liability is split into expected cash flows, risk adjustment, CSM and loss component. A split between coverage and claims is also required, and presentation must distinguish between insurance and reinsurance assets and liabilities.

Measurement and presentation should identify the applied models (GMM, PAA, VFA) and the transition method (FVA, MRA, FRA/regular).

Focus shifts from written premiums to services provided: service income and service expenses. Disclosures distinguish services for past, current or future periods, and reconcile changes by model/transition approach.

Updates to assumptions under IFRS 17 may impact insurance liabilities and therefore equity. Transitional impacts may be presented on first application.

We help banks and insurers translate complex regulatory frameworks — IFRS 17, IFRS 9, Solvency II and ESG — into clear data models, reporting chains and actionable dashboards. With over 10 years of experience across Finance and IT, we bridge the gap between strategy and implementation.

Implemented a new IFRS and Solvency II reporting chain including controls and dashboards.

Adjusted MRAP, Solvency II and SOx controls to comply with new regulations; supported multiple reporting periods.

Supported integration of data streams between ASR and Aegon.

Years of insurance reporting experience: accounting policies, bookkeeping and IFRS 17 reporting.

Certified in analysis frameworks (e.g., BABOK / BCS). We translate IFRS into clear requirements and data elements.

Data warehousing and engineering expertise to design pragmatic, robust implementation strategies.