Achmea

Implemented a new IFRS and Solvency II reporting chain including controls and dashboards.

IFRS 17 introduces grouping, new definitions and measurement models. Below is a concise overview.

Contracts are grouped by portfolio and profitability (profitable/onerous/may become onerous) by annual cohort. Offsetting results across groups is not permitted.

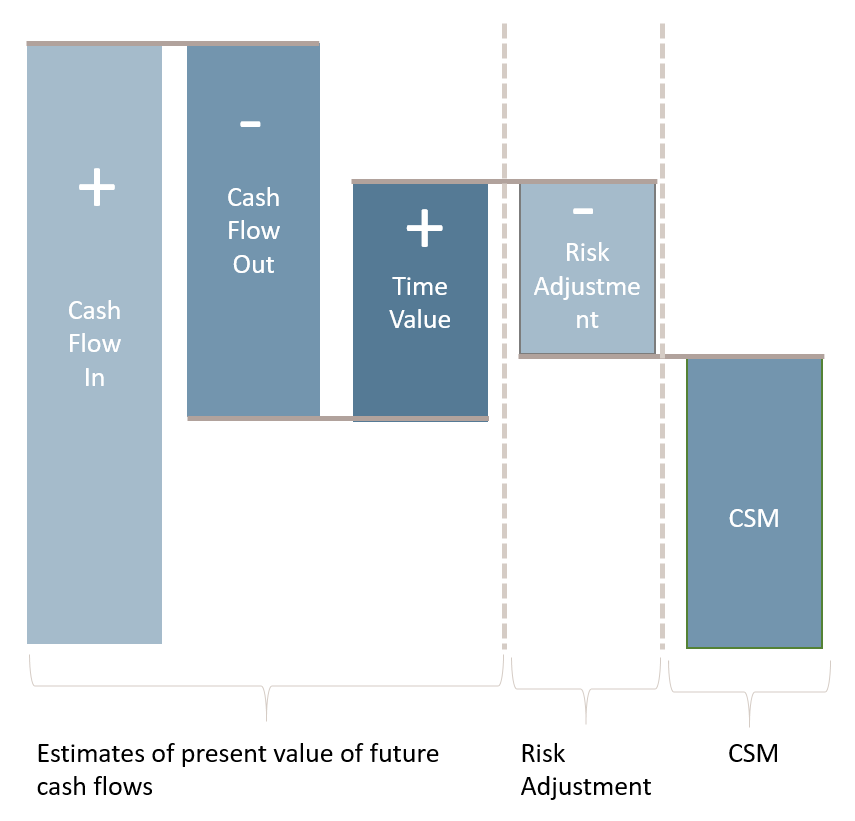

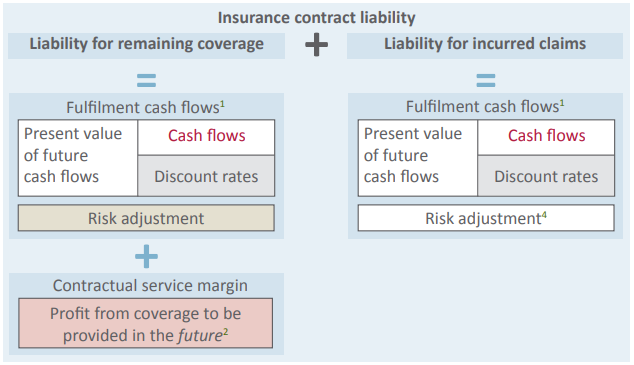

Recognise fulfilment cash flows (discounted), risk adjustment and CSM/loss component on balance sheet; release CSM to P&L as service is provided. No day-1 profit.

Simplified approach for eligible short-duration or qualifying groups; claims measurement aligns with GMM while coverage period uses a simplified liability for remaining coverage.

Applied to contracts with direct participation features; subsequent measurement differs as the insurer’s fee varies with underlying items.

We help banks and insurers translate complex regulatory frameworks — IFRS 17, IFRS 9, Solvency II and ESG — into clear data models, reporting chains and actionable dashboards. With over 10 years of experience across Finance and IT, we bridge the gap between strategy and implementation.

Implemented a new IFRS and Solvency II reporting chain including controls and dashboards.

Adjusted MRAP, Solvency II and SOx controls to comply with new regulations; supported multiple reporting periods.

Supported integration of data streams between ASR and Aegon.

Years of insurance reporting experience: accounting policies, bookkeeping and IFRS 17 reporting.

Certified in analysis frameworks (e.g., BABOK / BCS). We translate IFRS into clear requirements and data elements.

Data warehousing and engineering expertise to design pragmatic, robust implementation strategies.